Shoosmiths 2024 Predictions: Technology sector outlook

Artificial Intelligence (AI)

Alex Kirkhope – IT & Tech Partner

With Collins Dictionary naming “AI” its word of the year, there is no disputing that artificial intelligence has been the world’s most talked about technology of 2023. Following the emergence of Generative AI platforms, such as OpenAI’s ChatGPT and Microsoft’s Copilot, we have seen governments across the globe struggling to keep pace with the advances in AI. In 2024, we expect to see the continued rapid growth of AI offerings, along with inevitable developments and debates around regulation.

2024 will see the first major regulatory regimes come into force for AI. With the EU set to finalise the text of its wide-reaching AI Act early in the year, and the UK government due to define its own next steps following 2023’s AI White Paper, legislators will need to decide whether they ‘stick or twist’ when it comes to AI regulation. Throw in the prospect of major elections in both the UK and US next year for good measure, and the scope for continued change in the legislative landscape – how governments decide to balance innovation in AI with its perceived risks - will only continue. Organisations that take proactive step to develop responsible AI compliance and governance frameworks in 2024 that align with emerging regulation will stay a step ahead of the competition.

AI (both in generative and other formats) is only going to become more powerful and more widely adopted across all sectors, and in increasingly mainstream applications. But with that growth we can also expect to see ever-greater pressure on the infrastructure on which AI relies – the data centres, GPUs, energy demands and communications networks on which large AI systems operate. Some say we risk hitting a ceiling of capacity, particularly in western Europe, where infrastructure planning and energy grids are already playing catch-up with the compute demands of large AI models. It is all too easy to be caught surfing the hype curve on AI, but for that reason CTOs should be applying the same rigour to the resilience, performance and sustainability of their AI contracts as they would for any other transformational IT procurement.

Quantum Computing

Joe Stephenson – IT & Tech Partner

After AI, quantum computing will be the next shift we see worldwide in the tech sector. Quantum computing promises to transform various sectors, such as finance and pharmaceuticals. However, it also poses a serious threat to data security, as it can break the current encryption standards. Therefore, businesses and government leaders need to adopt a balanced and informed approach to deal with the ethical and security challenges of quantum computing. We are unlikely to see the full emergence of quantum computing in 2024 (or may be for several years after that), but 2024 will be a milestone for the quantum computing field, as it will see the transition from physical qubits, which are prone to errors, to error-corrected logical qubits, which are more reliable and scalable. The year ahead will also witness increased global collaboration in quantum research, as more countries and organisations join the quantum race.

Blockchain & Digital Assets

The UK is poised to become a leader in the regulation and innovation of digital assets, especially stablecoins. By the end of 2024, the UK aims to bring stablecoins within the existing regulatory framework, allowing for spot trading and clearing of these assets. Moreover, the UK plans to create a securities depository system for digital assets, starting with stablecoins, to facilitate trading and clearing operations. These initiatives will make the digital assets markets more comparable to the traditional securities markets in terms of scope, look and feel.

However, the UK also faces some challenges and uncertainties in the digital assets space. The new Operational Resilience rules and the Critical Third Party regime will require more guidance and clarity from the regulators and the industry. The UK will also issue its first digital Gilt, or government bond, testing the market appetite and the technical feasibility of this innovation. On the other hand, the UK will not pursue the development of a central bank digital currency, or Brit Coin, in the near future. Finally, the digitisation of securities project, led by Sir Douglas Flint, will encounter resistance from retail shareholders and share registrars/nominees, who may perceive it as a threat to their interests and roles.

FinTech

Luke Stubbs – IT & Tech Partner

The FinTech market will undergo further consolidation, as some smaller and less profitable players will be bought out by bigger and more established ones. This will be especially evident in the areas of payments, embedded finance, and ‘buy now, pay later’ (BNPL) services. Big tech and large players will also continue to push into the retail market, looking to offer more convenience and incentives to consumers, this may push smaller players to be more innovative.

FinTech will to an extent shift its focus from “newness” and disruption to maturity and stability. The appeal of new and innovative offerings for millennials and Gen Z which may not have a tangible benefit - other than being “on trend” - may fade, as these customers grow older and more concerned about the fundamentals. FinTech providers will also need to demonstrate more revenue and profit potential to their investors. As a result, more FinTechs will target more mature and lucrative markets, such as insurance, mortgages, investments, and pensions, where they can attract more affluent, older users.

Connected Tech

Network as a Service (NaaS) is a new way for enterprises to manage their network infrastructure more with flexibility, scalability, and affordability. By letting a service provider handle their WAN, NaaS combines features like pay-as-you-go, API-based operations, self-service, automated ad-hoc provisioning, and a wide range of interconnection services in one package. NaaS providers are competing with traditional carriers in the size and scope of their global networks. They can help multinational organisations connect different sites such as offices, factories, and remote workers. NaaS offerings are becoming more popular. This trend will mature in 2024.

5G networks will be much faster and more efficient, opening up new opportunities for working remotely, getting medical care online, and using other high-bandwidth applications. With 5G, people can enjoy real-time streaming of high-quality video and audio content, even in places with poor connectivity. But 5G networks also pose challenges for data security and privacy. More devices online means more chances for data leaks and cyber-attacks. Therefore, it is important that businesses and governments act to protect 5G networks and reduce these risks.

Tech Investment & Growth

Aleks Bosch – Corporate Partner

Whilst the mergers and acquisitions (M&A) market is expected to remain slightly more subdued than the period from 2021-2023, Tech M&A funded by private equity is expected to keep rising, driven by the accelerated pace of digital transformation and attractive valuations of target companies. Notable deals may happen in areas like AI, Blockchain, FinTech and Software as a Service (SaaS) to name a few, as companies look to acquire or invest in innovative companies, to gain a competitive advantage.

With AI and machine learning being at the forefront of discussion globally, companies specialising in these areas will be raising interest from private equity, with the potential to disrupt existing industries proving attractive. The backlog of companies looking to go public may also drive an increase in M&A activity through 2024 as investors seek alternative exit strategies.

With businesses embracing automation, particularly AI tools across functions, acquisitions centred around process automation capabilities, low-code/no-code tools are anticipated to increase. As part of a broader trend to digitalise functions, companies are increasingly leveraging digital tools and AI/automated processes to improve efficiency, drive growth and ultimately create value.

AI is also likely to see an explosion in usage by deal teams themselves, seeking to automate diligence streams. Typically, for a “billable hours” heavy operation, those firms leveraging AI and machine learning to automate and streamline diligence workstreams will be stealing a march on their rivals with regards to efficiency of dealmaking and profitability, whilst also supercharging the speed and accuracy of the diligence by reducing the scope for human error.

Summary

Undoubtedly, we are entering another golden era of technology. Some might go so far as to say we are witnessing a fourth industrial revolution, with the wider adoption and increased sophistication of technologies such as AI, Blockchain and Connected Technology, and a proliferation of data exchange and automation.

2024 will almost certainly represent another seminal year in this journey, bringing with it a wealth of exciting and innovative technological developments. However, as the technologists look to scale at pace during 2024, there will be increasing pressure to do so responsibly. Greater regulation looks an inevitable outcome for a number of these technologies. Any such regulation will have to carefully balance the need for nimble, unencumbered innovation with the necessity of protection from bad actors. Therefore, it will be critical for the industry and regulators to work collaboratively to establish a regulatory framework that enables, not impedes, responsible progress.

You can view the article published on Shoosmiths website here.

Redefining web 3.0: Emerging economies, metaverse technologies, and the new age of the internet (with Shoosmiths)

Join techUK as we explore metaverse and web 3.0 technologies.

There are still a few tickets left for techUK's Redefining web 3.0 event, taking place at Shoosmiths' London offices on 31 Jan.

Attendees will learn how these technologies will interact to spark innovative business models and new opportunities.

Sign up free to attend the presentations, panel discussions, networking session and tech demo area.

techUK – Unleashing UK Tech and Innovation

The UK is home to emerging technologies that have the power to revolutionise entire industries. From quantum to semiconductors; from gaming to the New Space Economy, they all have the unique opportunity to help prepare for what comes next.

techUK members lead the development of these technologies. Together we are working with Government and other stakeholders to address tech innovation priorities and build an innovation ecosystem that will benefit people, society, economy and the planet - and unleash the UK as a global leader in tech and innovation.

For more information, or to get in touch, please visit our Innovation Hub and click ‘contact us’.

Latest news and insights

Other forms of content

Sprint Campaigns

techUK's sprint campaigns explore how emerging and transformative technologies are developed, applied and commercialised across the UK's innovation ecosystem.

Activity includes workshops, roundtables, panel discussions, networking sessions, Summits, and flagship reports (setting out recommendations for Government and industry).

Each campaign runs for 4-6 months and features regular collaborations with programmes across techUK.

techUK's latest sprint campaign is on Robotics & Automation technologies. Find out how to get involved by clicking here.

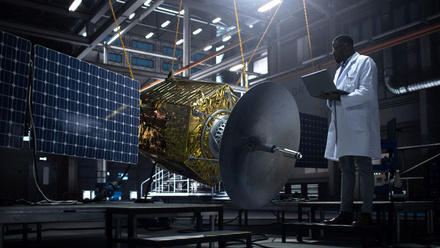

Running from September to December 2023, this sprint campaign explored how the UK can lead on the development, application and commercialisation of space technologies, bring more non-space companies into the sector, and ultimately realise the benefits of the New Space Economy.

These technologies include AI, quantum, lasers, robotics & automation, advanced propulsion and materials, and semiconductors.

Activity has taken the form of roundtables, panel discussions, networking sessions, Summits, thought leadership pieces, policy recommendations, and a report. The report, containing member case studies and policy recommendations, was launched in March 2024 at Satellite Applications Catapult's Harwell campus.

Get in touch below to find out more about techUK's ongoing work in this area.

Event round-ups

Report

Insights

Get in touch

Running from January to May 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of the technologies set to underpin the Gaming & Esports sector of the future.

These include AI, augmented / virtual / mixed / extended reality, haptics, cloud & edge computing, semiconductors, and advanced connectivity (5/6G).

Activity took the form of roundtables, panel discussions, networking sessions, Summits, and thought leadership pieces. A report featuring member case studies and policy recommendations was launched at The National Videogame Museum in November 2024.

Get in touch below to find out more about techUK's future plans in this space.

Report

Event round-ups

Insights

Get in touch

Running from July to December 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of web3 and immersive technologies.

These include blockchain, smart contracts, digital assets, augmented / virtual / mixed / extended reality, spatial computing, haptics and holograms.

Activity took the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in 2025).

Get in touch below to find out more about techUK's future plans in this space.

Event round-ups

Insights

Get in touch

Running from February to June 2025, this sprint campaign is exploring how the UK can lead on the development, application and commercialisation of robotic & automation technologies.

These include autonomous vehicles, drones, humanoids, and applications across industry & manufacturing, defence, transport & mobility, logistics, and more.

Activity is taking the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in Q4 2025).

Get in touch below to get involved or find out more about techUK's future plans in this space.

Upcoming events

Insights

Event round-ups

Get in touch

Campaign Weeks

Our annual Campaign Weeks enable techUK members to explore how the UK can lead on the development and application of emerging and transformative technologies.

Members do this by contributing blogs or vlogs, speaking at events, and highlighting examples of best practice within the UK's tech sector.