What is Web3, and what impact will DeFi have on traditional financial structures?

|

Web3 is a movement that embraces decentralisation and aims to democratise the building, operation, and ownership of the internet amongst its users. Web3 will empower users to take control of their funds and data, rather than relying on centralised institutions and outdated financial infrastructure. At its core, Web3 relies on a handful of fundamental principles, in that it is decentralised, permissionless, and trustless, One such area of the Web3 ecosystem which has an immense potential to transform the way we interact with the internet is through decentralised finance (DeFi) and self-custody digital wallets. Despite a global economic downturn prompting a tumultuous regulatory landscape for digital assets in recent months, the DeFi revolution continues to disrupt existing market structures, as well as presenting a compelling use case of blockchains that is helping drive value for various types of digital assets. DeFi applications can connect Internet-connected users anywhere in the world to the entire global financial system, facilitating a wide range of decentralised financial services such as payment, exchange trading, staking, and lending/borrowing, with lower transaction costs, faster settlement, and financial inclusion. Why are stablecoins important?Stablecoins - whose value is tied to that of another currency, commodity, or financial instrument - are seen as means of connecting traditional financial markets and decentralised financial markets, without the volatility typically associated with crypto-assets. Stablecoins are therefore essential, as they provide a consistent unit of account for DeFi applications and smart contracts, which compose a considerable part of the Web3 ecosystem. Stablecoins are particularly advantageous when compared to fiat on/off-ramps from the Web3 ecosystem, as they typically avoid high fees, eliminate delays, and facilitate cross-border transactions without needing multiple bank accounts. What impact will stablecoins have on the Web3 and DeFi ecosystem?In offering 24/7 instant settlements on a provably neutral, shared global ledger, stablecoins will become a core part of the global payments infrastructure over the coming decade. Some of their primary benefits are: 1. Separation of currency and jurisdiction can overcome a significant operational hurdle in that with digital assets, the movement of stablecoins does not require clearance through on-shore domestic banks, facilitating transactions which are entirely separate from the jurisdiction of the individuals or the currencies. For un- or under-banked individuals - whether that's because of a lack of physical access to banking facilities or wider institutional factors such as hyper-inflation – the use of Web3 services such as self-custody wallets can facilitate cross-border transactions with a variety of stablecoins, requiring only an internet connection. This provides individuals with meaningful access to the global financial system and control of their financial future without requiring any bank accounts to facilitate payments. 2. A fully connected on-chain foreign exchange and payment system will significantly reduce delays and costs. Ranging from large-scale corporate financing to small-scale company treasurers transacting internationally, the shift from transacting in fiat currency during limited banking hours to 24/7 digital money markets will open up a wide range of financial opportunities. Requiring only a digital wallet which is capable of holding a range of stablecoins, asset managers will find themselves able to transact at all hours across the globe, optimising strategic growth and financial freedom. 3. The ability to monetise your own data by retaining full control over your own data, and storing it in your Web3-enabled digital wallet. On Web3, your interactions with communities, applications, and websites will be managed by your digital wallet, and this will retain ownership and control over any data you manage and distribute. Since you are the owner of that data, you will be able to freely monetise it (as many already do on Web 2.0) through novel financing solutions, transacting directly with stablecoins to facilitate easy fiat on/off-ramps. Additionally, once you no longer wish to use a platform, you will be able to leave and take all of your data with you. What is the regulatory landscape for stablecoins?The international reputation of crypto-assets and stablecoins is becoming increasingly established, with the European Union recently adopting the Markets in Crypto-Assets Regulation, providing a harmonised framework for crypto-assets across the continent. Across the Atlantic, Washington is seeing various stablecoin-related bills soon to hit the House floor, with the U.S. unlikely to want to fall behind in both regulating and benefitting from these new assets. These bills – namely, the Financial Innovation and Technology for the 21st Century Act, the Clarity for Stablecoins Act, and the Keep Your Coins Act – seek to clarify regulation of digital assets, provide a regulatory framework for payment stablecoins, and protect the right to self-custody of digital-assets. The recognition and regulatory stability afforded to stablecoins by international legislation such as the above will be integral to the technology delivering on its potential. techUK – Unleashing UK Tech and InnovationThe UK is home to emerging technologies that have the power to revolutionise entire industries. From quantum to semiconductors; from gaming to the New Space Economy, they all have the unique opportunity to help prepare for what comes next. techUK members lead the development of these technologies. Together we are working with Government and other stakeholders to address tech innovation priorities and build an innovation ecosystem that will benefit people, society, economy and the planet - and unleash the UK as a global leader in tech and innovation. For more information, or to get in touch, please visit our Innovation Hub and click ‘contact us’. Latest news and insightsOther forms of contentSprint CampaignstechUK's sprint campaigns explore how emerging and transformative technologies are developed, applied and commercialised across the UK's innovation ecosystem. Activity includes workshops, roundtables, panel discussions, networking sessions, Summits, and flagship reports (setting out recommendations for Government and industry). Each campaign runs for 4-6 months and features regular collaborations with programmes across techUK. techUK's latest sprint campaign is on Robotics & Automation technologies. Find out how to get involved by clicking here.

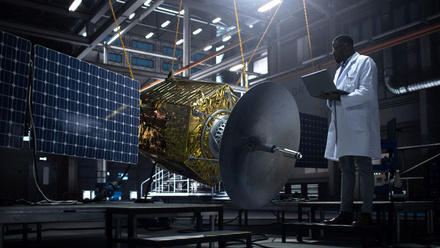

New Space

Running from September to December 2023, this sprint campaign explored how the UK can lead on the development, application and commercialisation of space technologies, bring more non-space companies into the sector, and ultimately realise the benefits of the New Space Economy. These technologies include AI, quantum, lasers, robotics & automation, advanced propulsion and materials, and semiconductors. Activity has taken the form of roundtables, panel discussions, networking sessions, Summits, thought leadership pieces, policy recommendations, and a report. The report, containing member case studies and policy recommendations, was launched in March 2024 at Satellite Applications Catapult's Harwell campus. Get in touch below to find out more about techUK's ongoing work in this area. Event round-upsReportInsightsGet in touch

Gaming & Esports

Running from January to May 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of the technologies set to underpin the Gaming & Esports sector of the future. These include AI, augmented / virtual / mixed / extended reality, haptics, cloud & edge computing, semiconductors, and advanced connectivity (5/6G). Activity took the form of roundtables, panel discussions, networking sessions, Summits, and thought leadership pieces. A report featuring member case studies and policy recommendations was launched at The National Videogame Museum in November 2024. Get in touch below to find out more about techUK's future plans in this space. ReportEvent round-upsInsightsGet in touch

Web3 & Immersive

Running from July to December 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of web3 and immersive technologies. These include blockchain, smart contracts, digital assets, augmented / virtual / mixed / extended reality, spatial computing, haptics and holograms. Activity took the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in 2025). Get in touch below to find out more about techUK's future plans in this space. Event round-upsInsightsGet in touch

Robotics & Automation

Running from February to June 2025, this sprint campaign is exploring how the UK can lead on the development, application and commercialisation of robotic & automation technologies. These include autonomous vehicles, drones, humanoids, and applications across industry & manufacturing, defence, transport & mobility, logistics, and more. Activity is taking the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in Q4 2025). Get in touch below to get involved or find out more about techUK's future plans in this space. Upcoming eventsInsightsEvent round-upsGet in touchCampaign WeeksOur annual Campaign Weeks enable techUK members to explore how the UK can lead on the development and application of emerging and transformative technologies. Members do this by contributing blogs or vlogs, speaking at events, and highlighting examples of best practice within the UK's tech sector. SummitsTech and Innovation Summit 2025Tech and Innovation Summit 2023Tech and Innovation Summit 2024Receive our Tech and Innovation insightsSign-up to get the latest updates and opportunities across Technology and Innovation. |