How in-orbit servicing capabilities are building a new infrastructure in space

In the late nineteenth century the Benz Patent Wagen was the state-of-the-art motor car. Hand-built, capable of 10mph and generating 500W of output from a lightweight engine, it was at the cutting-edge of automotive technology. And yet, no more than twenty-five were made between 1886 and 1893. In 1907, Henry Ford produced his iconic Model T, and by 1927 had sold fifteen million of them. The innovations Ford made were not only in the car but in the production and assembly line. Easier maintenance, standardised components and chassis parts, mass fabrication, and a partly automated manufacturing system drove down costs for both manufacturers and owners.

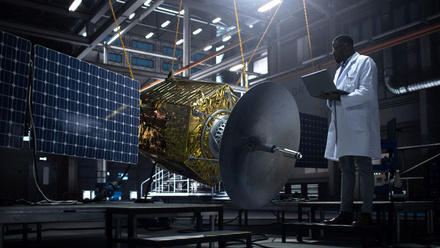

The traditional business model of the space sector has been to manufacture hand-built, one-and-done spacecraft to fulfil a very specific mission brief. This is expensive, and time-consuming. But the cost of launch is coming down thanks to the efforts of commercial launchers such as those offered by SpaceX, and the new commercial entrants to the space market want greater flexibility, adaptability, maintainability, advanced customisation, and reduced costs.

We’re at our Model T moment.

Space companies and users are already using advanced robotics, AI, imaging, decision-making, sensing, and planning capabilities in their spacecraft. These technologies are now being coupled with a new philosophy of spacecraft design and manufacture: namely, mass fabrication, an adoption of modular builds and standardised systems and components, and a drive towards the more sustainable use of space, including the salvaging, re-use, and recycling of spacecraft and their materials and components.

In-Orbit Servicing will be first and primary market to take advantage of these technologies, and bring benefits to users, operators and investors alike. There are several missions planned up to 2030, including ESA’s, and this all follows Northrup Grumman’s successful MEV missions. In-orbit servicing encompasses a wide variety of services and operations occupying the “midstream” section of the space sector spectrum, offering refuelling, exchange of active payload modules, salvage, repair, upgrades, and even the physical reconfiguration of satellites to alter their form and function.

These capabilities will build a new infrastructure in space, one where interoperability, modularity, standardisation and open architectures are the norm. An openly available set of standards for robotic interconnectors, interfaces, and modules will enable new entrants to the market to work alongside established movers and shakers, in much the same way that USB connections and App Store source codes can be exploited by any developer on the ground.

This is not only desirable but necessary. The UK National Space Strategy lists a range of emerging space sectors the UK is well-placed to support and grow. In-orbit servicing is listed as the first, but in reality the technologies and capabilities required to perform in-orbit operations will act as stepping-stones to the next generation of the emerging sectors listed: in-space manufacturing, space-based construction and assembly; space-based solar power; exploration and in-situ resource utilisation. All of these sector areas require the adoption of this new philosophical approach. Space-based solar power alone will require spacecraft of such vast magnitude and complexity that a multitude of different entities are required to make it work.

In-orbit servicing is now a commercial sector. Users’ desires for greater spacecraft flexibility and adaptability will be fulfilled not by space agency operations but by commercial vehicles. The UK Space Agency’s driving ambition is to catalyse investment into the space sector, and connect investors with innovative developers and service-providers. Businesses offering components and systems that adhere to this new design philosophy will find opportunities for investment and funding.

The UK government is acting to de-risk several of the technologies required for this emerging sector, not least by acting as the initial customer for the Active Debris Removal IOD mission, currently in Phase B. This may act not only as a demonstrator for the relevant capabilities, but also to show that the UK government, as an IOD customer, can provide stepping stones to businesses accessing space and proving their commercial credentials and the viability of the market.

The UK Space Agency is committed to connecting innovative space SMEs with investors via its Space Investment Forums, Space Catalyst Fund, and membership of the ESA Scale-Up Invest programme, while wider Government is implementing the Private Investment Framework via the Department of Business & Trade.

techUK – Unleashing UK Tech and Innovation

The UK is home to emerging technologies that have the power to revolutionise entire industries. From quantum to semiconductors; from gaming to the New Space Economy, they all have the unique opportunity to help prepare for what comes next.

techUK members lead the development of these technologies. Together we are working with Government and other stakeholders to address tech innovation priorities and build an innovation ecosystem that will benefit people, society, economy and the planet - and unleash the UK as a global leader in tech and innovation.

For more information, or to get in touch, please visit our Innovation Hub and click ‘contact us’.

Upcoming events

Latest news and insights

Other forms of content

Sprint Campaigns

techUK's sprint campaigns explore how emerging and transformative technologies are developed, applied and commercialised across the UK's innovation ecosystem.

Activity includes workshops, roundtables, panel discussions, networking sessions, Summits, and flagship reports (setting out recommendations for Government and industry).

Each campaign runs for 4-6 months and features regular collaborations with programmes across techUK.

techUK's latest sprint campaign is on Robotics & Automation technologies. Find out how to get involved by clicking here.

Running from September to December 2023, this sprint campaign explored how the UK can lead on the development, application and commercialisation of space technologies, bring more non-space companies into the sector, and ultimately realise the benefits of the New Space Economy.

These technologies include AI, quantum, lasers, robotics & automation, advanced propulsion and materials, and semiconductors.

Activity has taken the form of roundtables, panel discussions, networking sessions, Summits, thought leadership pieces, policy recommendations, and a report. The report, containing member case studies and policy recommendations, was launched in March 2024 at Satellite Applications Catapult's Harwell campus.

Get in touch below to find out more about techUK's ongoing work in this area.

Event round-ups

Report

Insights

Get in touch

Running from January to May 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of the technologies set to underpin the Gaming & Esports sector of the future.

These include AI, augmented / virtual / mixed / extended reality, haptics, cloud & edge computing, semiconductors, and advanced connectivity (5/6G).

Activity took the form of roundtables, panel discussions, networking sessions, Summits, and thought leadership pieces. A report featuring member case studies and policy recommendations was launched at The National Videogame Museum in November 2024.

Get in touch below to find out more about techUK's future plans in this space.

Report

Event round-ups

Insights

Get in touch

Running from July to December 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of web3 and immersive technologies.

These include blockchain, smart contracts, digital assets, augmented / virtual / mixed / extended reality, spatial computing, haptics and holograms.

Activity took the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in 2025).

Get in touch below to find out more about techUK's future plans in this space.

Event round-ups

Insights

Get in touch

Running from February to June 2025, this sprint campaign is exploring how the UK can lead on the development, application and commercialisation of robotic & automation technologies.

These include autonomous vehicles, drones, humanoids, and applications across industry & manufacturing, defence, transport & mobility, logistics, and more.

Activity is taking the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in Q4 2025).

Get in touch below to get involved or find out more about techUK's future plans in this space.

Upcoming events

Insights

Event round-ups

Get in touch

Campaign Weeks

Our annual Campaign Weeks enable techUK members to explore how the UK can lead on the development and application of emerging and transformative technologies.

Members do this by contributing blogs or vlogs, speaking at events, and highlighting examples of best practice within the UK's tech sector.

Summits

Tech and Innovation Summit 2025

Tech and Innovation Summit 2023

Tech and Innovation Summit 2024

Receive our Tech and Innovation insights

Sign-up to get the latest updates and opportunities across Technology and Innovation.