Collaboration and communities fuel Quantum’s funding

There are lots of things about quantum physics that we do not know yet. However, that has not stopped us from applying it to new technologies. From HealthTech applications to atomic clocks, quantum-powered innovation changes the way we engage with the world. As a result of this, the quantum economy contributes £1.7 billion in GVA to the UK economy and employs an estimated 20,000 people, while also showing huge amounts of growth.

Grant funding for quantum R&D has been critical for this outcome. Our Quantum Economy RTIC counts 562 companies, of which 157 alone raised £311 million in Innovate UK grants.

This is not breaking news. We already knew that quantum technologies receive lots of funding, but we decided to dive deeper. Interestingly, Innovate UK grants can be requested by a consortium. This means that we can identify groups of companies that tend to work more with each other than with the rest.

We found 5 collaboration communities that define the groups of companies leading quantum innovation. Let’s take a closer look.

How we did it

First, we took all the companies in our Quantum Economy RTIC and checked which ones had received a grant from Innovate UK. Then, for those that received a grant, we looked for the ones that received it in partnership with one or more than one company—92 in total.

It is interesting to see that these 92 companies raised £286 million in grants. This is 92% of the total raised, suggesting that consortium grants are responsible for most of the funding achieved. Ultimately, we ran community detection analysis over the collaboration data.

The results are visualised on the graph below. The bubbles in the graph represent the 92 companies. The size of the bubbles shows the total number of collaboration grants won by a company, and the colour represents the community it was identified into. The links between the bubbles show whether two companies have ever received a grant in partnership. The bubbles in white represent companies identified in a nonsignificant community.

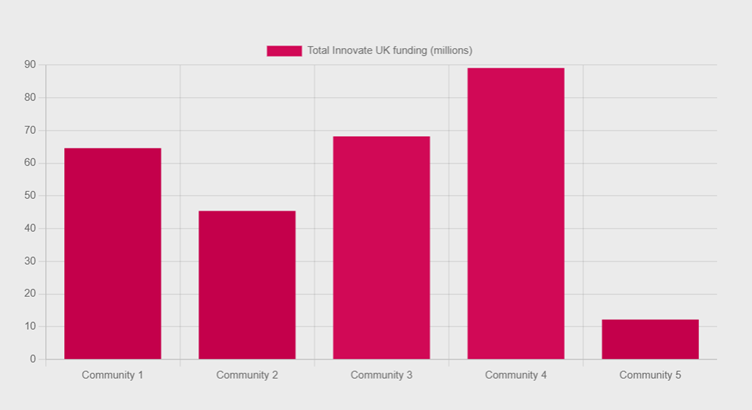

This analysis not only allows us to see how companies collaborate in quantum R&D, but can also tell us which communities are more effective at raising funding. The graph below shows the aggregate total funding received by companies in each community since 2004.

In this case, we learn that community 4 raised considerably more funding than the rest. The data also tells us that companies in community 4 were especially successful during 2023’s investment rounds. They raised £43.8 million in 2023, almost 50% of all investment secured by this community.

We also find that companies developing key materials for the the quantum economy, like Siver Photonics or IQE, won significantly more funding than others. This suggests that securing and diversifying materials for quantum technologies is currently a priority from public funding bodies.

Where are the communities?

From previous work, we know that research communities are not necessarily geographically adjacent. Some may be disperse. Either way, finding out the geographical spread of these communities represents an opportunity for policy makers, investors and other researchers to empower those that make the communities possible, and those that can make them grow.

In this case, we can see how the smallest community, community 5, is located between Bristol, Cambridge and London. Thinking about ways to encourage the collaboration between community 5 with other strong communities present in the area could contribute to the strengthening of the innovation structure.

What have we learnt?

We’ve learnt that:

-

Research consortiums tend to be more successful at winning research grants

-

Quantum tech companies organise in 5 collaboration communities

-

There is an investment gap between these communities

These are all key findings, but we can still dig deeper.

Do companies in a community tend to research the same topics? How do universities play a role? Do they cluster? These are questions that we would like to explore in the future.

You can visit The Data City's website by clicking here.

Click here to view 55+ insights & vlogs on quantum, metaverse, space, AI, semiconductors, compute and policy.

Plus, access the event round-ups & recordings for our 'Industries of the Future: Space' and 'Future Visions: AI and Semiconductors' webinars.

techUK – Unleashing UK Tech and Innovation

The UK is home to emerging technologies that have the power to revolutionise entire industries. From quantum to semiconductors; from gaming to the New Space Economy, they all have the unique opportunity to help prepare for what comes next.

techUK members lead the development of these technologies. Together we are working with Government and other stakeholders to address tech innovation priorities and build an innovation ecosystem that will benefit people, society, economy and the planet - and unleash the UK as a global leader in tech and innovation.

For more information, or to get in touch, please visit our Innovation Hub and click ‘contact us’.

Latest news and insights

Other forms of content

Sprint Campaigns

techUK's sprint campaigns explore how emerging and transformative technologies are developed, applied and commercialised across the UK's innovation ecosystem.

Activity includes workshops, roundtables, panel discussions, networking sessions, Summits, and flagship reports (setting out recommendations for Government and industry).

Each campaign runs for 4-6 months and features regular collaborations with programmes across techUK.

techUK's latest sprint campaign is on Robotics & Automation technologies. Find out how to get involved by clicking here.

Running from September to December 2023, this sprint campaign explored how the UK can lead on the development, application and commercialisation of space technologies, bring more non-space companies into the sector, and ultimately realise the benefits of the New Space Economy.

These technologies include AI, quantum, lasers, robotics & automation, advanced propulsion and materials, and semiconductors.

Activity has taken the form of roundtables, panel discussions, networking sessions, Summits, thought leadership pieces, policy recommendations, and a report. The report, containing member case studies and policy recommendations, was launched in March 2024 at Satellite Applications Catapult's Harwell campus.

Get in touch below to find out more about techUK's ongoing work in this area.

Event round-ups

Report

Insights

Get in touch

Running from January to May 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of the technologies set to underpin the Gaming & Esports sector of the future.

These include AI, augmented / virtual / mixed / extended reality, haptics, cloud & edge computing, semiconductors, and advanced connectivity (5/6G).

Activity took the form of roundtables, panel discussions, networking sessions, Summits, and thought leadership pieces. A report featuring member case studies and policy recommendations was launched at The National Videogame Museum in November 2024.

Get in touch below to find out more about techUK's future plans in this space.

Report

Event round-ups

Insights

Get in touch

Running from July to December 2024, this sprint campaign explored how the UK can lead on the development, application and commercialisation of web3 and immersive technologies.

These include blockchain, smart contracts, digital assets, augmented / virtual / mixed / extended reality, spatial computing, haptics and holograms.

Activity took the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in 2025).

Get in touch below to find out more about techUK's future plans in this space.

Event round-ups

Insights

Get in touch

Running from February to June 2025, this sprint campaign is exploring how the UK can lead on the development, application and commercialisation of robotic & automation technologies.

These include autonomous vehicles, drones, humanoids, and applications across industry & manufacturing, defence, transport & mobility, logistics, and more.

Activity is taking the form of roundtables, workshops, panel discussions, networking sessions, tech demos, Summits, thought leadership pieces, policy recommendations, and a report (to be launched in Q4 2025).

Get in touch below to get involved or find out more about techUK's future plans in this space.

Upcoming events

Insights

Event round-ups

Get in touch

Campaign Weeks

Our annual Campaign Weeks enable techUK members to explore how the UK can lead on the development and application of emerging and transformative technologies.

Members do this by contributing blogs or vlogs, speaking at events, and highlighting examples of best practice within the UK's tech sector.