Placing Nature Risk on the Global Agenda (Guest Blog by Marsh)

As discussed in Can We Insure the Natural World, nature offers both risks and opportunities for businesses.

In 2020, research by the World Economic Forum (WEF) indicated that more than half of global GDP, US$44 trillion of economic value generation, is moderately or highly dependent on nature and its services.1 Yet threats to nature are accelerating, creating new risks for organizations.

There is a significant international will to counter nature loss. The UN Convention on Biological Diversity (CBD) Secretariat launched in 2021 a first draft of a new Global Framework for managing nature by 2030. Other global alliances, such as the Science Based Targets Network (SBTN) and Earth Commission identify tipping points, science-based targets, and guidance to predict and transform the relationship between companies, societies, and nature. Moreover, organizations such as the Network of Central Banks and Supervisors for Greening the Financial System (NGFS) have collaborated with central banks to mobilize the finance needed for this transition to a nature-positive economy.

While much of this is guidance and best practice at the current time, we can expect to see more regulation which may result in businesses being driven to pivot their operations, potentially resulting in additional compliance costs, loss of revenue, and stranded assets, especially following the UN Nature Rescue Plan that targets 30% of the Earth’s surface across land and sea to become protected areas by 2030. Amidst this uncertainty, businesses should think long term about how they look to their entire value chain and their interfaces with nature, preempting shifts in consumer behavior and regulatory frameworks.

Inspired by the Task Force on Climate-related Financial Disclosures, the Taskforce on Nature-related Financial Disclosures (TNFD) follows the same logic that increasing awareness of the financial materiality of nature loss will lead businesses to adopt sustainable practices.

About TNFD

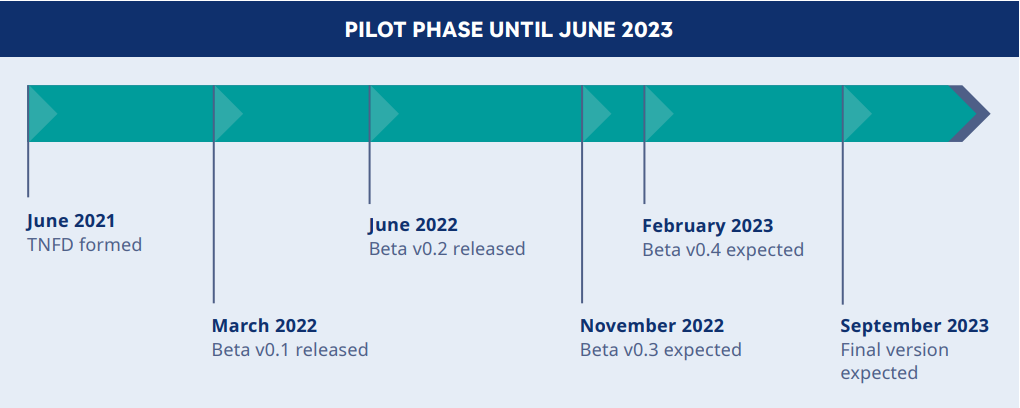

The TNFD formed in June 2021 to deliver a risk management and disclosure framework, with the ultimate goal of redirecting capital flows towards nature-positive outcomes. With endorsements from the United Nations, leading financial institutions, and members representing a market capitalization of over US$19.4 trillion,3 the TNFD follows an open innovation approach to enable organizations to:

• Incorporate nature in corporate risk management.

• Provide standardized assessment and disclosure metrics and targets for corporations and authorities.

• Inform financial institutions to identify and quantify nature-related financial risks as well as opportunities.

To test and promote usability and impact of its framework, the TNFD invites organizations to pilot its Beta framework and take part in the framework’s development.

What the TNFD framework has released so far

First, the assessment framework for nature-related risk and opportunities has been developed through the Beta version 0.1 and version 0.2. Some of the key outputs of the first releases are:

• A coherent and consistent nature-related language system and fundamentals to understand nature.

• LEAP Nature Risk Assessment Approach.

• LEAP-FI, the LEAP approach for financial institutions.

• Draft guidance on dependency and impact metrics.

• Piloting guidance.

Among others, TNFD continues the development of:

• Risk, opportunity, and response metrics.

• Sector-specific guidelines.

• SBTN-aligned nature-related scenarios, including the systematic relation of nature with climate change and its societal impact.

• Disclosure framework.

What does this mean for clients and insurers?

Businesses will face increasing pressure from their investors, underwriters, and stakeholders to reveal their nature-related risks and opportunities. Companies that do not disclose their impacts and dependencies on nature may find their risks misrepresented by third-party estimates. As financial institutions fortify their portfolios for the future, companies that don’t appear to openly address their nature risks may be an unattractive investment.

Nature loss poses a significant material risk to the insurance industry in addition to climate risk due to major uncertainties about the cost of capital, cost of insurance, and how to transfer risk. Insurers may face challenges due to lack of historical and meaningful loss data to rely on as well as relevant metrics that define value to business and value to society for their decision making. Equally, there are potential opportunities for insurers as nature-positive actions could often be aligned with risk mitigation. For example, if a company restores a wetland ecosystem within/adjacent to their site, it could reduce the likelihood and/or severity of a flood damage.

TNFD disclosures will provide key insights not only for insurers’ underwriting and asset management decisions, but also for product innovation by allowing financial institutions to understand dependencies and impacts of businesses on nature and ultimately the actions needed for transition to a naturepositive economy.

As risk advisors, Marsh can bridge the gap between better risk management and a nature-positive future. TNFD disclosures will help organizations in all sectors to move towards a more resilient future.

-

Marsh Contacts

Gunes Ergun Engagement Manager, Climate and Sustainability Strategy [email protected]

Nick Faull Head of Climate and Sustainability Risk [email protected]

Amy Barnes Head of Climate and Sustainability Strategy [email protected]

techUK – Committed to Climate Action

By 2030, digital technology can cut global emissions by 15%. Cloud computing, 5G, AI and IoT have the potential to support dramatic reductions in carbon emissions in sectors such as transport, agriculture, and manufacturing. techUK is working to foster the right policy framework and leadership so we can all play our part. For more information on how techUK can support you, please visit our Climate Action Hub and click ‘contact us’.