Digital Engagement Platform: Empowering Banks to better serve their SME customers

Guest blog by Dhritiman Mukherjee, Managing Partner, Banking & Financial Services & Dr. Łukasz Dutkiewicz, Director, Business Development, DXC Technologies

Introduction

SME Clients are underserved in EU and UK Markets

Banks have traditionally focused on their large corporate customers and mass-market retail customers with innovation and offerings, leaving the small and medium enterprises (SMEs) somewhat underserved. As a result, SMEs have had to accept several limitations in services. While a SME generates less revenue compared to a large corporate, when the number of entities and their business dynamics is considered, they constitute a very important business segment. Moreover, the expectations of SME clients are very different from that of corporates. SMEs typically have very limited administrative and financial resources, therefore they expect their banking activity to be conducted in a seamless, automated, remote way – very similar to the way it is done in retail. Also, SME customers demand more advanced, tailored products compared to retail customers. For these reasons, banks often end up underserving their SME customers leading to higher levels of customer dissatisfaction, churn and loss of potential revenues.

This expectation gap between the process imposed by the bank and the business habits of the SME client result in lost opportunity on both sides. The SME client feels underserved, and the bureaucratic barrier of entry prohibits them from consuming more, even necessary services, while the bank misses the opportunity to sell new products and gain more information on the customer in seamless manner.

Digital Engagement platform for SME banking

We believe that the provision of a modern, seamless, SME focused, digitally enabled, customer engagement platform will help both SME clients and their banks to strengthen mutual cooperation and win new business, very much following the success of digital banking for retail clients that opened new ways to consume banking as well as other services (e.g. embedded finance).

Key features of such modern digital engagement ecosystem will include:

- An omnichannel digital user interface – it should be possible to onboard advanced services in a digital first way.

- The product management layer provides flexibility and is the enabler for the bank to react swiftly to changing market and customer demands and enable packaging of new services e.g. rule/incentive-based product packages, volume-based pricing, loyalty schemes etc.

- Value added services / Creating an ecosystem : there is increasing demand from SMEs to enable value added services enabling international business e.g. cross border payment capability, management of taxes and invoices, protection of payments, virtual cards, insurance or cybersecurity etc.

- There is an opportunity for the bank to provide services beyond traditional banking e.g. tools to aid cash flow management, invoicing, digital signature or secure document management. This increases customer loyalty and retention by the bank.

Proposed approach

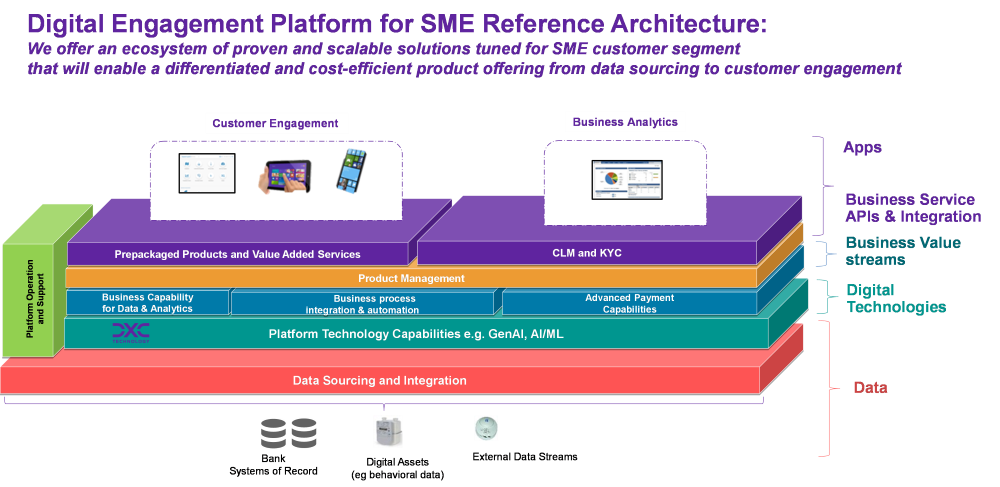

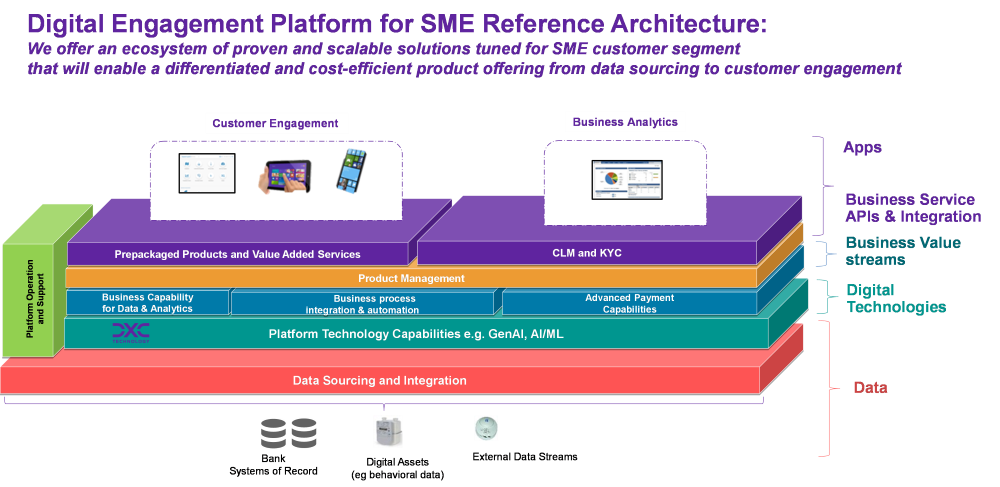

Rather than relying on a single product or vendor we recommend a modular framework approach where individual building blocks are integrated within the existing landscape and selected based on the scale and functionality needed to address the enterprise strategy. One of the benefits of a modular approach is that multiple sources of data provide more effective analytics and decision-making. Key components of the architecture include customer engagement; product management; an efficient data management layer; an analytics engine and client onboarding.

Each bank will follow its own path based on their business and customer strategy, driven by their specific market and customer segments but there will be certain common principles that in our opinion constitute the reference architecture of a modern customer engagement platform:

Conclusion

Our recommended approach includes the Bank to understand their SME customer’s needs and then drawing up a business and market strategy for SME clients. Then the Bank can work together with a SI partner to customize the SME Digital Engagement Platform design and architecture to fit their customer’s needs and align with the business strategy and plans. The platform can be implemented as a holistic solution or can be aligned and integrated with specific elements within ther existing systems landscape with minimum disruption.

Financial Services Programme activities

The techUK Financial Services programme connects tech firms, the FS industry, and regulators to ensure innovation and technology can be fully embraced. Through market engagement activities and events, we help to empower decision makers and aid collaboration.

Upcoming events

Latest news and insights

Learn more and get involved

Financial Services updates

Sign-up to get the latest updates and opportunities from our Financial Services programme.

Meet the team

James Challinor

Head of Financial Services, techUK

James leads our financial services programme of activity. He works closely with member firms from across the sector to ensure innovation and technology are fully harnessed and embraced by both industry and regulators.

Prior to joining us James worked at other business organisations including TheCityUK and the Confederation of British Industry (CBI) in roles focused on supporting the financial & related professional services eco-system, with a particular focus on financial technology and market infrastructure.

He holds degrees from King's College London and Oxford Brookes University, and outside of work enjoys socialising, exercising, and travelling to new locations.

- Email:

- [email protected]

- LinkedIn:

- https://www.linkedin.com/in/james-challinor-105212177/

Read lessmore

Lucas Banach

Programme Assistant, Data Centres, Climate, Environment and Sustainability, Market Access, techUK

Lucas Banach is Programme Assistant at techUK, he works on a range of programmes including Data Centres; Climate, Environment & Sustainability; Market Access and Smart Infrastructure and Systems.

Before that Lucas who joined in 2008, held various roles in our organisation, which included his role as Office Executive, Groups and Concept Viability Administrator, and most recently he worked as Programme Executive for Public Sector. He has a postgraduate degree in International Relations from the Andrzej Frycz-Modrzewski Cracow University.

- Email:

- [email protected]

- Phone:

- 020 7331 2006

- Twitter:

- @techUK

- Website:

- www.techuk.org

- LinkedIn:

- https://www.linkedin.com/in/lucas-banach-50139650

Read lessmore

Authors

Lukasz Dutkiewicz

Director Business Development, Financial Services, DXC

Dhritiman Mukherjee

Managing Partner, Financial Services, DXC