Tech Strategic Suppliers: strong performance, but can’t be complacent

A small number of companies do so much business with the government and provide such vital services that the Cabinet Office takes a more hands-on approach to managing procurement with them. It designates them ‘Strategic Suppliers’.

As of May 2022, there were 40 Strategic Suppliers, of which 14 are technology suppliers: Accenture, Atos, AWS, Capgemini, Capita, CGI, Computacenter, DXC Technology, Fujitsu, IBM, Leidos, Microsoft, Oracle and Sopra Steria.

As part of our 2022 Interim Report on the Strategic Suppliers, we’ve dug into the market positions of these 14 tech giants. Below, Tussell’s founder – Gus Tugendhat – reflects on some of our major findings into this group:

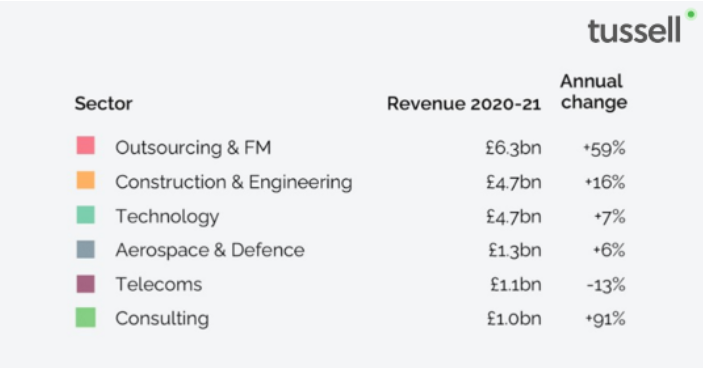

1. Tech Strategic Suppliers earned £4.7bn from the public sector in the year to Sep-2021, an annual increase of 7%. Interestingly, this is slower growth than in the government’s overall IT procurement spend over the same period of 14%. In effect, this means that the tech Strategic Suppliers have lost market share.

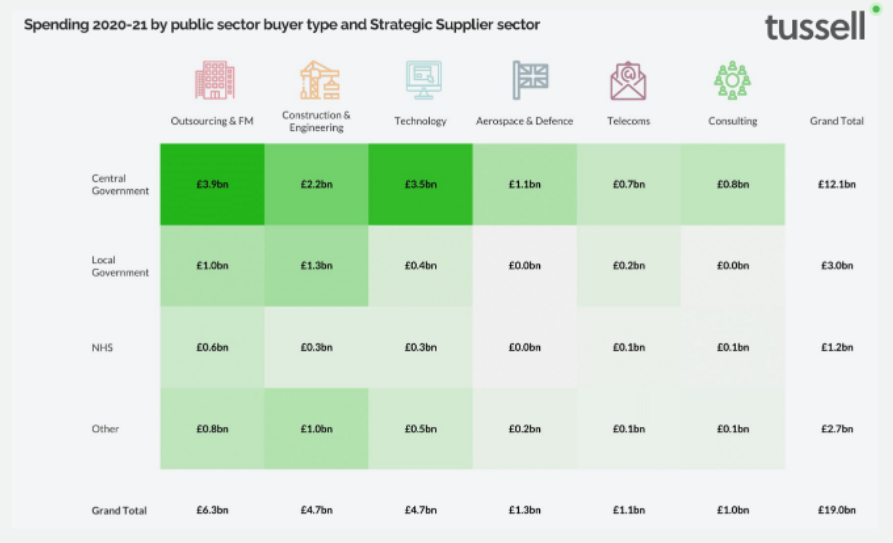

2. Tech Strategic Suppliers are especially reliant on Central Government customers, which accounted for 75% (£3.5bn) of their total revenue. Local Government and the NHS mostly rely on a different range of technology suppliers of this total spend.

3. Three tech Strategic Suppliers grew their public sector revenue by a third or more in the year to Sep-2021: Computacenter (79%), Accenture (55%) and IBM (33%). Three other tech Strategic Suppliers saw a fall in public sector revenue compared to the prior period.

4. With public sector revenue of £365mn over the period, SoftCat is the biggest public sector tech supplier not currently designated as a Strategic Supplier. Could it be deemed “strategic” in the future?

While public sector spend on technology is growing rapidly, the market share of the tech Strategic Suppliers actually shrank last year. This is evidence of the success of the government’s policy to diversify its top technology suppliers and to disaggregate large contracts where possible.

Furthermore, new competitors are entering this market all the time. So, the tech Strategic Suppliers will need to adapt constantly in order to maintain their incumbency – finding new parts of the public sector to expand into, and getting better at partnering with the SMEs and local suppliers from which the government wants to purchase more goods and services as part of its recent Procurement Reform Bill.”

*

To access the full Strategic Suppliers 2022 Interim Report, click here.

This blog was originally authored by Gus Tugendhat (Founder) and James Piggott (Marketing Executive), Tussell.